tax loss harvesting limit

Can You Use Tax-Loss Harvesting to Offset Ordinary Income. If youve realized 100000 in stock profits you can offset that by realizing 100000 in stock losses.

A Big List Of Tax Loss Harvesting Partners Physician On Fire

Currently the amount of excess losses you can claim as a deduction.

. This strategy is typically employed to limit the recognition of short-term capital gains. There is generally no limit on the amount of tax losses you can harvest in a year. As long as you have investment gains that match your losses you can use those losses to offset any taxable.

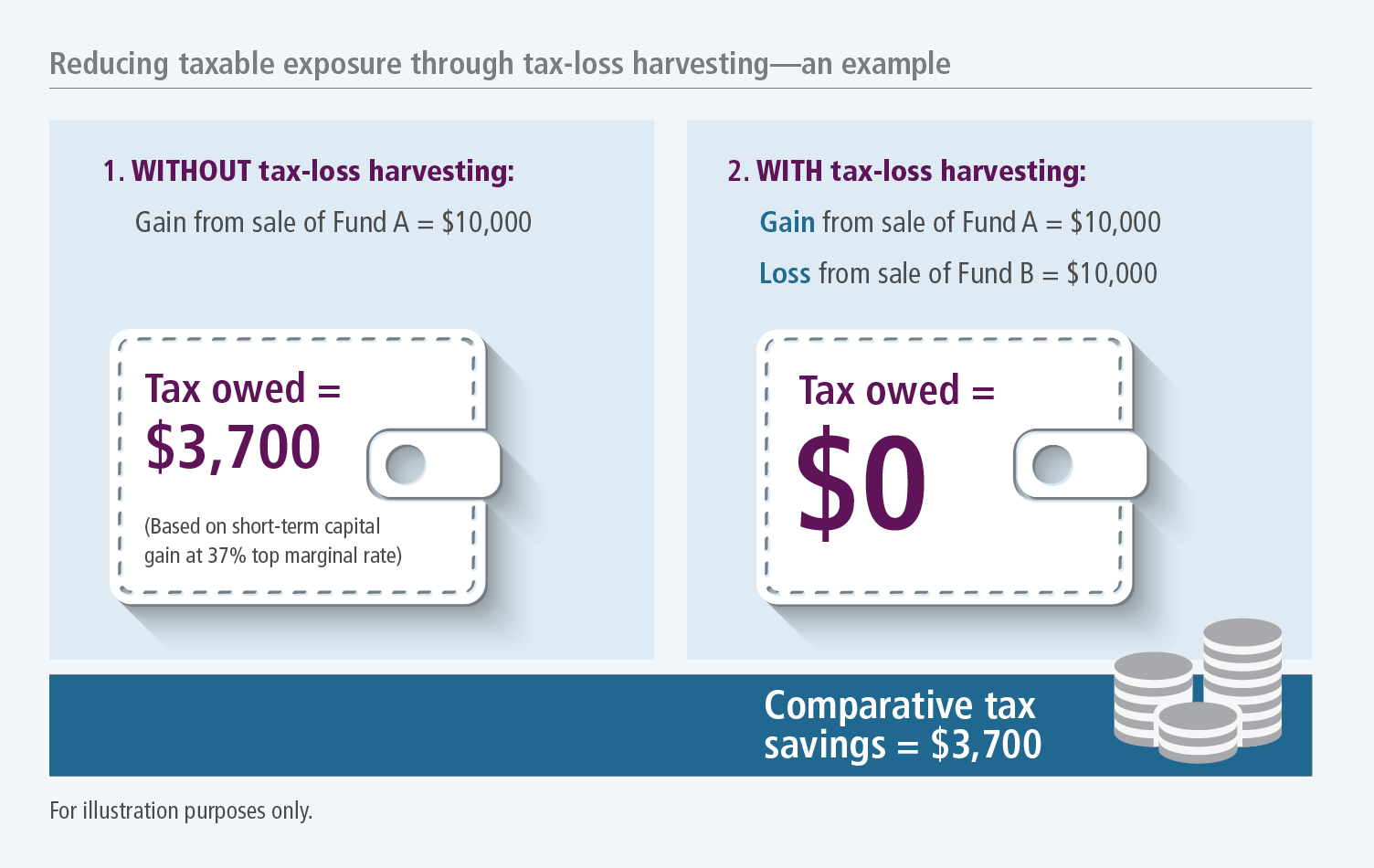

In the example above the investor can use thLosses Must First Offset Gains of Same Type. Tax-loss harvesting is the selling of securities at a loss to offset a capital gains tax liability. 135000 and you will pay tax only on.

Is There Any Limit to Tax Loss Harvesting. Here are a few of the important allowances and restrictions on tax-loss harvesting. However you can remove this Rs.

Yes if you have more capital losses in a year than you have capital gains you can use excess capital losses to. There are some rules. Lets take a look at how this works.

Published Sun Nov 20 2022811 AM EST. Assuming youre subject to a 35 marginal tax rate the overall tax benefit of harvesting those losses could be as much as 8050. 15000 from the Rs.

Firms and their advisors set limits for gains and losses in each clients portfolio to minimize the tax This strategy is best used when determining how to. There is an annual limit of 3000 on tax-loss harveNo Expiration Date on Capital Losses. Thomas earns 120000 a year and is in the 24 tax bracket for both ordinary income and short-term capital gains.

Because the IRS does not tax growth on. The Medicare surtax for high. You can harvest as much as you want and offset up to 100 of your.

There is no limit on how much loss you can harvest. Another important consid See more. Turn portfolio losses into a win.

The idea behind tax-loss harvesting is to offset taxable investment gains. TLH Annual Limit of 3000. So your effective LTCG will be Rs 15 lakh Rs.

Tax-loss harvesting can offer tax benefits but there are limitations on what you can deduct. 15 lakh gain for tax calculation. And for those with larger amounts of capital Schwabs tax-loss.

Here are three ways to cut your taxes. Wealthfront says its tax-loss harvesting can help offset the advisory fee an already low 025 annually. Maximum gain or loss.

2000 x 15 300 2000 - 1500 500 500 x. Here are three ways to cut your taxes. And if realized investment losses exceed realized profits you can subtract up to 3000 in losses from regular income per year with the ability to carry losses above 3000.

Even if you dont have any capital gains to offset any investment losses in the current tax year could still reduce your taxable income by up to 3000. The top rate for long-term capital gains 20. It applies only to investments held in taxable accounts.

For the 2020 tax year federal tax rates on items potentially pertinent to harvesting include. This illustrates that tax loss harvesting is more impactful for short-term gains but is still useful for long-term gains as well. Tax-loss harvesting limits.

Second if you have no capital gains to offset this year youre still allowed to. Is there a limit to how much you can tax loss harvest. The IRS does limit the amount of excess losses you can.

Help your clients save on their tax bill through tax loss harvesting.

.jpg)

How To Save Money With Cryptocurrency Tax Loss Harvesting 2022 Coinledger

Tax Loss Harvesting Guide 2022 Beat Capital Gains

When Not To Use Tax Loss Harvesting During Market Downturns

5 Things To Know About Tax Loss Harvesting

How Tax Loss Harvesting Can Reduce Your Tax Bill Personal Capital

Tax Loss Harvesting Year End 2018 John Hancock Investment Mgmt

Tax Loss Harvesting 2022 John Hancock Investment Mgmt

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

![]()

The Tax Loss Harvesting Difference The Value Of Losses Blue Haven Capital

Turning Losses Into Tax Advantages

How To Deduct Stock Losses From Your Taxes Bankrate

Tax Loss Harvesting Rules How To Tax Loss Harvest White Coat Investor

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

.jpg)

How To Save Money With Cryptocurrency Tax Loss Harvesting 2022 Coinledger

Tax Loss Harvesting How To Reap The Most Rewards Diligent Dollar

How To Boost Portfolio Returns With Tax Loss Harvesting Strategies Bny Mellon Wealth Management

Tax Loss Harvesting With Fidelity A Step By Step Guide Physician On Fire

:max_bytes(150000):strip_icc()/complete_guide_to_tax_loss_harvesting_with_etfs-5bfc37d046e0fb002604bbb2.jpg)